Are you hoping to retire early? Or looking for additional income to pay off your debts? Perhaps trying to cope with the rising costs of living in Singapore?

Whatever your reason(s) may be, there are many different ways to make money online. And all you need is a laptop with a stable internet connection.

Before we venture into the top 8 ways to make money online and generate passive income in Singapore, it’s crucial to align your own interests and passions into profitable outcomes.

First Step Towards Passive Income

If you have a deep passion or interest in something, you can use it to generate additional income. Start by listing top interests that you could possibly turn into money-making skills.

It’s dependent on the goals you’ve set, what your interests are, and how much extra income you’re looking to generate.

Once you’ve written down your interests, make sure your skills and interests intersect. If you’re not too sure, you can gather input from your family and friends who know you well.

For example, if you’re an artsy person who enjoys crafting items, get their honest opinion on whether you make good and sellable products.

Additionally, research which opportunities are there for you. For example, if you’re good at photography, you can sell them through stock image websites.

Once you know how to sell your interests and skills, all you have to do is to work smart by setting your own rules and decisions that work best for you and your circumstances. Then, you can begin monetising your expertise.

Now that you’re all set, let’s take a closer look at the 8 ways you can make extra money online.

Here’s How You Make Money Online

In this list, all you need is some hard work, creativity and internet access. You can pick one, or a few of them, which suits you most.

-

Affiliate Marketing With a Website or Blog

One of the best ways to earn more money and turn it into a passive income is through affiliate marketing.

First, create a website – it could be a blog, news site, or a comparison website.

Next, with regular content posts on social media, grow an audience with the objective to achieve sizable views.

Once you start posting regularly, sign up to a few affiliate programmes and start marketing. Some of the popular ones are Lazada Affiliates, Outbrain, and Google Adsense.

The Lazada Affiliate program is great for those with blogs focusing on product reviews, to monetise their content and following. Many users have concurred that the registration process is quite easy, as all it takes a few clicks and a simple form to complete.

Outbrain, on the other hand, is very different from Lazada. Many users use this platform to share content pieces of their blog onto advertising channels to increase exposure. If that interests you, Outbrain is the place to go.

Google AdSense, is another great option where you can monetise your website traffic. It advertises third-party services or products to your site visitors. A great feature of Google AdSense is that it gives you the option to let them do the ads’ optimisation. That way, they only show the best converting ads to maximise your earnings.

Do keep in mind that affiliate marketing usually requires time – realistically, up to a year to see results and profits.

-

Freelance Work

Providing freelance skills is also a way to make more money. Depending on your skills and experience, you can pick from hundreds of freelance opportunities from Fiverr and Upwork. This includes creative writing, online translation, video production, programming, etc. But these platforms work differently.

The difference between Fiverr and Upwork is the account creation and how you get the work opportunities.

While these two platforms are excellent places for freelancers of all skill sets, Upwork’s vetting process is stricter as you have to apply for projects and reply to client invitations.

To create an account on Upwork, you must be approved before you can apply for projects and reply to client invitations, whereas anyone can open a Fiverr account.

Upwork is great for those who are more experienced. It’s a great online-based platform for freelancers who value flexibility.

On the other hand, Fiverr works differently – you sell your services through “Gigs“, which are great fuss-free opportunities to showcase your talent and work, provide buyers with relevant information and let them come to you.

Sign up on these freelance platforms and start connecting with dozens of people looking to hire your expertise.

-

Photography

If photography is your life-long passion, you’re sitting on a gold mine. In fact, you can even earn up to $3,000 a weekend if you’re an excellent photographer.

You can use free portfolio hosting sites like Behance, or if you’re on Adobe’s Creative Cloud subscription, you already have access to Adobe Portfolio, which allows you to showcase your work in minutes with customisable themes. Don’t forget to add in your contact info! Share your new website on social media platforms.

Speed up the process with the help of your family and friends to also share with their own contacts and networks. Referrals from them lend credibility. Regular posts online increase visibility – bonus points if your images go viral!

Another route is to go the stock photo way: take a bunch of unique and creative photos, and upload them on specific stock websites, such as Shutterstock, Alamy, or 500px. You get paid every time your photos are bought.

Naturally, the more photos you post, the more opportunities for your work to be noticed and picked, leading to more money you’ll be able to earn.

-

Online Courses

Creating online courses is also another excellent option to earn more money. It’s a great way to leverage your skills and earn passive income at the same time. However, it’s not for everyone.

Platforms such as Udemy and Skillshare allows you to build a course and teach anyone around the world. Earnings from these platforms essentially rely on volume: popular courses like yoga, programming usually have a higher demand compared to niche topics like, say, lawn bowling for example.

If you are an educator with professional certifications or possess expert knowledge on the industry you’re in, Udemy is a perfect ground for you to become a course creator with little effort.

Skillshare, on the other hand, is a great platform for creators who are looking to sell courses based on creative skills, such as how to become a photographer, writer, or learn to illustrate.

-

Sell things on Etsy for Extra Income

If you’re an artsy person who enjoys crafting items such as accessories, jewellery, supplies, bags or art — you can turn that talent into a profitable side hustle on Etsy. Selling items on Etsy isn’t expensive.

Conceptualise, create, and present online with well-captured images or videos. You can also pick up some tips from these five successful sellers who went full-time into their passions! Experiment and see what works for you.

As a matter of fact, the listing fee is US$0.20 (S$ 0.27 at the time of writing this article). When you sell an item, the transaction fee is 5%, and Etsy will take 4.4% of commission including a payment processing fee of $S0.35.

-

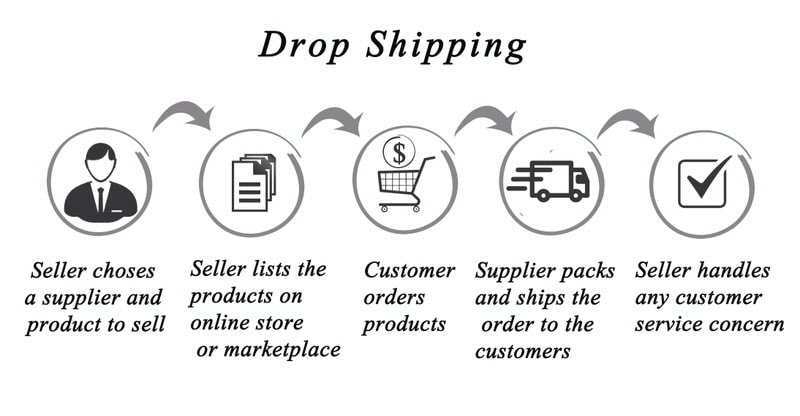

Start Your Own Online Shop aka Dropshipping Service

Dropshipping is another excellent way to earn passive income. All that is required is a website, focusing on interesting niches, researching and communicating with relevant wholesale suppliers, then selling the products you’ve curated online on platforms such as Lazada, Carousell, Shopee, Shopify and Amazon.

Basically, once a customer places and pays for an item from your online store, you buy the product from the supplier, and have them ship directly to the customer – no need to deal with maintaining an inventory, or the logistical aspect of the sale.

Before you embark on this option though, so make sure to thoroughly review if the supplier is a dependable source, and periodically assess which products are in demand and adjust accordingly.

The next phase could be for you to develop your relationship with trusted suppliers. They have been in the industry longer – seek input from them which products have demand or show increasing demand. Work with them to improve on existing products, or create new ones. After all, the more they manage to sell through you, the better it is for them as well!

-

Crowdfund Startup Companies

If you have extra cash and looking to double that amount without doing any legwork, crowdfunding websites are the answer to that.

To name some, GoFundMe is a great place where you can help support ideas as they need funding to begin their operations. Kickstarter is another excellent platform for crowdfunding investments as it’s convenient and has considerable reach.

Similar to Kickstarter, the birthed-in-Singapore platform We The People focuses on incubating and accelerating ideas for consumer goods through crowdfunding. They also allow you to invest in those companies through their ILO (Initial License Offering).

As with every option listed here, before you reach for your credit card and dedicate money to investment crowdfunding, do the necessary homework of reviewing financial information of these startups.

To illustrate this point, viewing the startup’s financial statement is a great way to show how well they are doing. Make sure to review their sales, net profit, margins, cash flow, etc.

-

Peer-to-peer Lending

If you’re not familiar with this, well it’s time for you to know more about this option.

There are many small startups in Singapore who are not eligible for bank loans or credit from other financial institutions.

An option for these companies is to go on P2P websites where people are willing to lend small sums to them. In return, these lenders will receive payments back with interest. In most cases, the interest rate can exceed up to 20% per annum.

P2P lending is an excellent option for those who are looking to grow their wealth long-term and not for those looking to protect their wealth.

As with other investment options, we do not recommend putting your savings or emergency fund into P2P. Because once you’ve invested the money, it’s locked in – you’re not able to take it out, as and when you like – you’ll have to wait until the loan amount is repaid.

For those looking to go into P2P, one such platform is SeedIn. It’s a P2P investment platform where you can gain access to SMEs’ short-term investments across the Asia Pacific. It offers the second-largest investment opportunities up to S$5 million in unsecured and secured business loans.

Another excellent recommendation is CoAssets. This P2P investment platform is dedicated to Singaporeans looking to invest in SMEs located in South-East Asia and Australia.

It provides longer investment durations (up to 3 years) compared to other P2P platforms. It’s also the only publicly listed (ASX) platform that provides transparency in the crowdfunding process.

Go Forth And Multiply… Your Money!

We hope these top 8 ways to make money online have given you sufficient basic information on how to improve your financial standing.

Besides hustling on side-gigs, give investment opportunities a try. You can generate passive income and achieve stable long-term financial growth by investing part of your savings.

If you prefer not to use your savings, or you have less money to invest in any of the suggested ventures, we offer Personal Loan options at Credit Excel Capital. You can use it to fund a startup or begin a new investment venture.

If you’d like to know more about what we can do for you, contact us and we can help you reach your financial goals earlier than expected.